Condo Insurance in and around Bakersfield

Welcome, condo unitowners of Bakersfield

Protect your condo the smart way

- California

- Kern County

- Bakersfield

- Tehachapi

- Los Angeles

- Sacramento

- Fresno

- San Luis County

- Arizona

- Bullhead City

- Texas

- Houston

Condo Sweet Condo Starts With State Farm

Your condo is your retreat. When you want to take it easy, unwind and laugh and play, that's where you want to be with the ones you love.

Welcome, condo unitowners of Bakersfield

Protect your condo the smart way

Protect Your Home Sweet Home

That’s why you need State Farm Condo Unitowners Insurance. Agent Elizabeth Cardenas can roll out the welcome mat to help generate a plan for your particular situation. You’ll feel right at home with Agent Elizabeth Cardenas, with a straightforward experience to get high-quality coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Elizabeth Cardenas can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

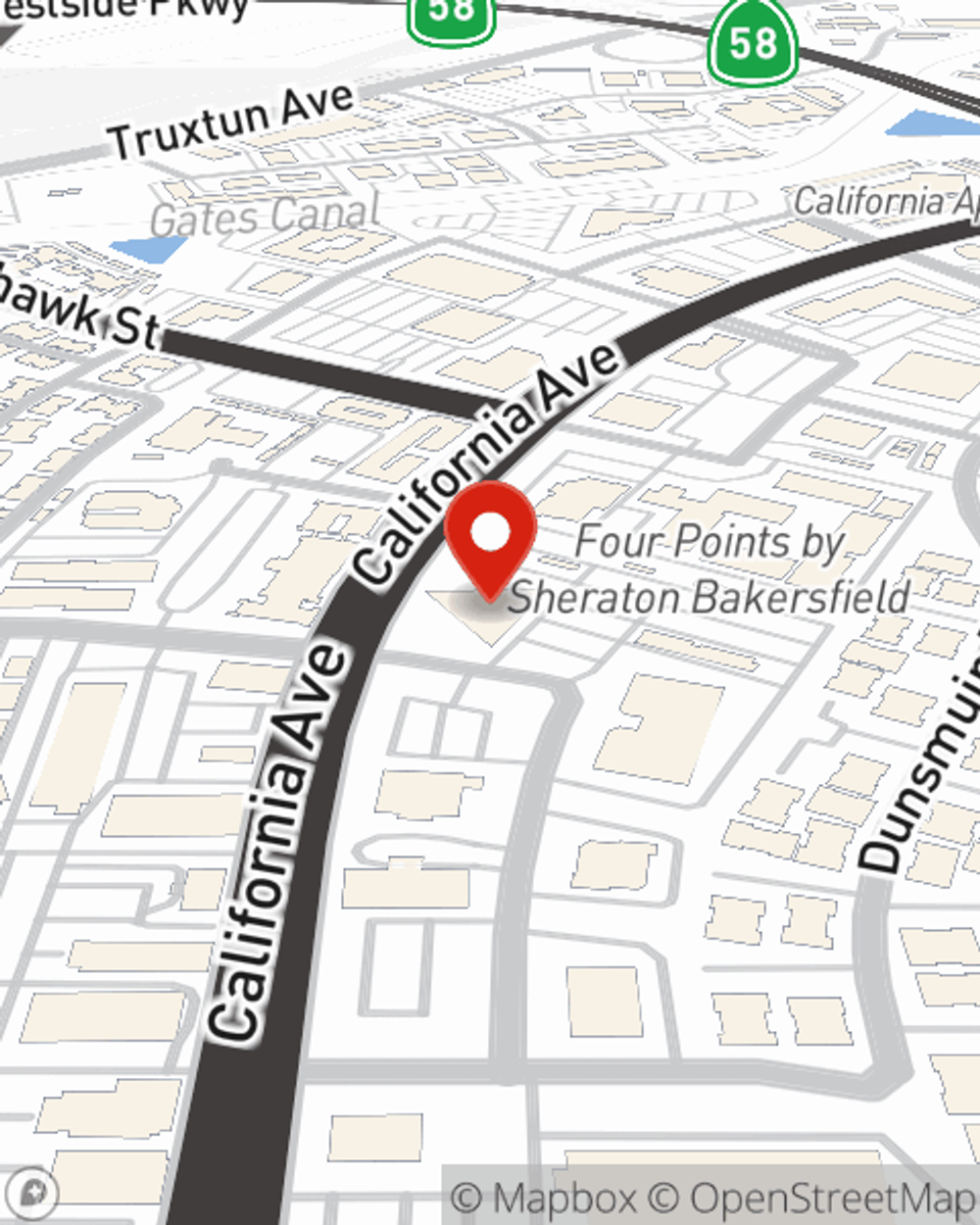

When your Bakersfield, CA, townhome is insured by State Farm, even if the unexpected happens, State Farm can help cover your condo! Call or go online today and find out how State Farm agent Elizabeth Cardenas can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Elizabeth at (661) 327-0838 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Elizabeth Cardenas

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.